Cheaper commodities will lower prices, boost volumes: HUL CEO

It’s a fact that inflation helped the company in posting higher headline numbers apart from its time-tested strategy of straddling the pyramid. But even when the company judiciously raised product prices to tackle inflation, it ensured its consumer franchise remained intact.

In the first half of the current fiscal, HUL added an incremental turnover of over Rs 4,000 crore, which could be the size of a smaller FMCG player. But the real test for Mehta would come from the December quarter onwards, when the net material inflation would likely come down, prompting price reductions.

Would HUL then be able to maintain its double-digit growth? In an interview with TOI, Mehta said that would mark the return of the elusive volume-led turnover growth after a year of moderation in the headline growth numbers. Excerpts:

What do you feel about the current operating environment?

India is one of the shining spots in the world today. Many times, emerging markets get battered because of the troika — balance of payment deficit, fiscal deficit and exchange rate depreciation. And this time, it is coupled with commodity inflation. However, this time, there is high inflation and a fear of looming recession even in developed markets.

If, as a nation, we can still deliver a 6-7% real GDP growth and if we can contain the consumer price inflation to about 7%, then we could look back at the year and say, ‘Well done, India!’

In these tough times, when the net material inflation was about 22% for our business in September quarter but the headline growth of the market is still 7%, it’s not that bad. If you look at inflation and the price increases, which are in the vicinity of an unprecedented 12-13% and then look at market growths, then it does indicate the resilience of consumer spending.

There are green shoots with September being better than July and August. But the fact that the volumes for the markets are at negative mid-single digit does indicate the challenging context and this is being seen not just in India but across the world.

On consumer confidence…

From the perspective of price points, premium — which we categorise as index 120 and above to the market average — is growing at a much faster pace. Popular is growing much faster than mass. On the one hand, people are gravitating towards price point packs. On the other, people are moving towards large-value packs. These are discernible shifts that have happened because, in price point packs, the relative price increase was much lower.

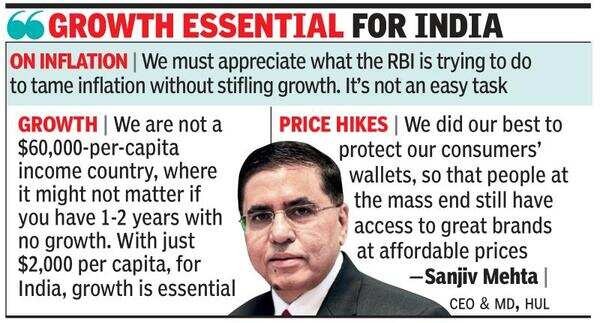

We did our best to protect our consumers’ wallets, so that people at the mass end still have access to great brands at affordable prices. During the current challenging period, the two imperatives we have are growing the consumer franchise, and protecting the business model. Market share gains for our business continue, and when you have an ebitda (earnings before interest, taxes, depreciation, and amortisation) of above 23% in these volatile times, we have also met the second objective of protecting the business model.

Have market share gains have come from smaller players?

It is very likely if we do a gain-loss analysis, the smaller players would have lost more. Our focus, however, is to ensure that we not only gain, but we make the share gain podium in most categories we operate in. We have not shied away from market development.

Our share of market is the biggest among all peer groups in the sector, and still maintaining a higher ‘share of voice’ is a pointer that we play the game for the long term. And in many ways, we are strengthening the brands. This results in share gains and creates the capacity to take price increases. When the brand is strong, you can take a price increase. But when it is weak or fledgling, it is difficult to increase prices.

What about HUL’s ‘straddling the pyramid’ strategy?

In a country like India, you can’t play only in one segment if you want to be a big player. You can be a niche player, but if you want to be a national player and if you want to be a category leader, you have to play the game of straddling the price-benefit pyramid.

On value growth now forming the bulk of turnover…

As long as inflation remains elevated, there will be price-led growth. However, looking at the macro picture within our categories where the FMCG market volumes have declined by 6%, HUL growing at 4% is very satisfactory. We have had seven quarters of double-digit growth, which indicates our ability to navigate the turbulence.

Would there be a return to volume growth and price reductions?

We will see volume pick up once commodity prices ease, leading to a reduction in prices. When prices start to come down there would be a year when the headline growth would see moderation and then we would again get into a phase where our turnover would be predominantly volume-driven.

If we remain laser-focused on protecting the consumer franchise and our business model, we will emerge victorious. When inflation goes back to moderation and stability, we will have a much bigger franchise, a much larger market share, stronger brands, and the business model will be strong enough to reinvest even more into our portfolio.

What’s your take on the strong headwinds and the taming of inflation?

I certainly believe that the RBI is doing a good job. They ensured sufficient liquidity when we went through Covid. They have been reasonably adept at changing the policy and raising interest rates, and that’s what you need to do to tame inflation. Inflation is a worry even in the US, the UK and much more in our neighbouring countries.

Considering this, we must appreciate what the RBI is trying to do to tame inflation without stifling growth. It’s not an easy task. We are not a $60,000-per-capita income country, where it might not matter if you have one or two years with no growth. With just $2,000 per capita, for India, growth is essential.

What do you feel about the global recession and its impact on the Indian market?

At the end of the fiscal, if we are able to deliver 6-7% growth and keep inflation at a 6-7% level, we can look back and say ‘Wow, we have managed the turbulence very well’. Besides demographics, today, we are fundamentally in a much stronger position. Look at how Industry 4.0 can play to our strengths versus the previous industrial revolutions.

The twin balance sheet problem is history now. Our banks are much more capitalised, and the overall level of corporate debt is much less. The direct transfer of subsidy, which has cut back on wasteful expenditure, enables the government to give food grains to the people who need it the most.

During this highly turbulent external environment, ensuring that no one goes hungry, ensuring that there is macroeconomic stability, ensuring that you tame inflation without stifling growth — that is what the government is working towards.

On Reliance’s entry in the FMCG market…

I certainly believe India is not a zero-sum game. It’s a massive market, and when more competitors come in, it’s good for consumers. You would have heard me say this often: A good competitor brings out the best in Hindustan Unilever. If we are focused on our consumers, if we give them superior products, if we ensure that the price-value equation remains intact, and if we keep investing in our capabilities, I am certain that consumers who have been loyal to HUL over the last nine decades will continue to extend their loyalty to HUL for many more decades to come.

What about D2C brands and the growth of e-commerce?

You can get customer data, but having different formulations for different parts of the country is not easy. Digital is still a small part of the business. You put all the new digital brands together and compare that with HUL’s half-year delta growth of Rs 4,000 crore — it puts things in perspective.

Do you still think having a large distribution in the digital age is a competitive advantage?

The mistake people make is that they swing on either/or. Life is not about either/or, life is about ‘and’. For a company like ours, 75% of the business is still general trade (GT). The question is, how do you bring in data and technology to reinvent business models? How do you customise the assortment for each store? GT may decline, but it will remain the dominant channel in a country as large and heterogeneous as ours.

Even in developed countries, e-commerce in FMCG is about 25% of the market. In the future, it will be a very different GT, which will be driven even more by data and technology. But e-commerce will play an important part, and that is why we are building huge capabilities in this arena. We go wherever consumers want to shop. For us, it’s not an either/or strategy. It’s an ‘and’ strategy.