Demat a/cs in India top 10 crore milestone

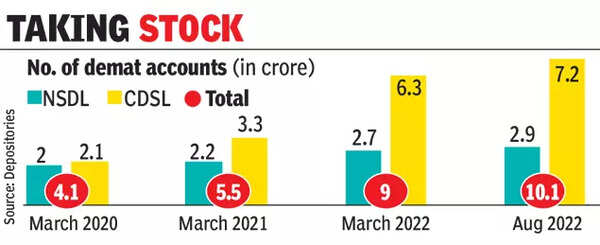

The latest data from the two depositories showed that, as of August end, CDSL had 7.2 crore demat accounts while the corresponding number for NSDL was 2.9 crore. In January 2021, the total number of demat accounts had crossed the 5-crore milestone, while the number was about 4.1 crore as of March 2020, data aggregated from the two depositories showed.

According to market players, some of the reasons for the rapid rise in the number of demat accounts include digitisation of the financial sector, proliferation of discount brokerages and the regulatory changes that paved the way for video-based eKYC (electronic-know your client) process. The rapid growth in the number of demat accounts is a sign of the spread of the equity culture outside of the metros and large cities.

The total number of demat accounts surpassing 10 crore indicates “that the culture in equity investing is slowly but steadily picking up in India, especially in tier-2 and -3 cities, which were under-served till now”, said Axis Securities MD & CEO B Gopkumar. “Higher participation of investors bodes well for the depth and development of equity markets in India, along with the availability of equity capital to companies through primary issuances.”

The latest data also showed that CDSL, which for a long time had played a second fiddle to NSDL, the country’s first depository, extended its lead over its older peer. With a 70% market share, its growth in terms of demat accounts has mainly been driven by discount brokerages.

According to a founder of one of the discount brokerages, although CDSL had a much lower cost structure than NSDL for long, traditional brokerages preferred to remain with NSDL. However, since discount brokerages operate on a lower cost structure, most went with CDSL. With the digitisation of the broking industry and video-enabled e-KYC in place, discount brokerages led the client-acquisition process in the broking industry. Along with the growth of discount brokerages, CDSL also saw a rapid rise in the number of demat accounts on its platform, the person had told TOI a few months ago.