Do not drop guard against inflation: IMF

In a presentation at a meeting of the G20 Sherpas in Udaipur earlier this week, the multilateral agency is learnt to have pointed to persistent inflation pressure, with the pace of price increase being stubbornly high in several countries, with inflationary expectation inching up in some parts of the world.

Supply chain disruptions following Covid as well as a spike in global commodity prices, following the war in Russia, have pushed inflation in the US and the UK to the highest level in over four decades. In India too, inflation had gone past the 7% level, but there are signs of moderation following a series of steps taken by the government and monetary tightening by the Reserve Bank of India, whichhas raised key policy rates by 225 basis points (100bps = 1 percentage point) since May.

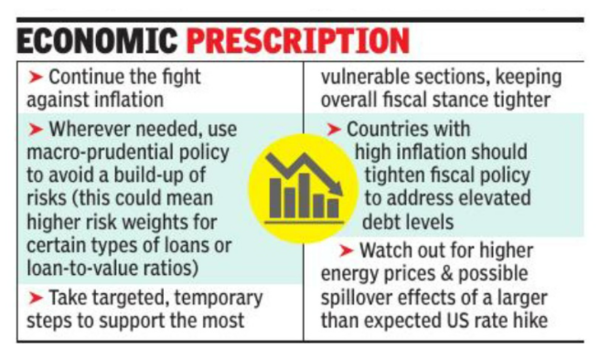

Although central banks across the world have responded by raising policy rates, adjusted for inflation, they remain low in many of the G20 countries, including India, it said. The IMF also warned of price pressures emanating from energy, sources said, while pointing to the possible spillover effects of a larger than expected US interest rate hike, which could result in dollar strengthening against other currencies, while also pushing up borrowing costs.

To deal with the impact of high prices, it advocated targeted and temporary fiscal measures to protect the poor and vulnerable segments of the population, while keeping the overall fiscal stance tighter.

The IMF pointed out that high food price inflation has prompted a cost-of-living crisis in several countries due to a food supply shortage. Sources said the globalagency also pointed to greater “food insecurity” due to a shortage of fertilisers.

The government has maintained that its free foodgrain scheme to the poor has helped cushion the impact. Besides, it has called for structural reforms, including a focus on helping children impacted by Covid lockdowns to make up for some of the education losses.