Energy prices to jump 60% in 2022, slide 11% in 2023: World Bank

But the multilateral agency’s latest commodity markets outlook report cautioned that despite the moderation, energy prices next year will still be 75% above their average over the past five years.

It also flagged a major risk, saying shrinking value of currencies of most of the developing economies is driving up food and fuel prices in ways that could deepen the food and energy crises that many of them already face.

Authorities in India have been battling high energy andfood prices for sometime. Rupee’s slide against dollar has also complicated the policy choices as authorities are working to shield the population from the impact of stubborn inflationary pressures.

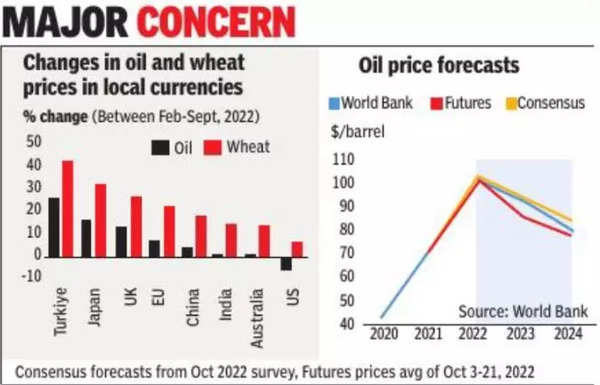

In dollar terms, prices of most of the commodities havedeclined from their recent peaks, amid concerns of an impending global recession, says the report. From the Russian invasion of Ukraine in February 2022 through the end of last month, the price of Brent crude oil in dollar fell nearly 6%.

Yet, because of currency depreciations, almost 60% of oilimporting emerging-market and developing economies saw an increase in domesticcurrency oil prices during this period. Nearly 90% of these economies also saw a larger increase in wheat prices in local-currency terms compared to rise dollar, according to the World Bank report.

It said the price of Brent crude is expected to average $92 a barrel in 2023 — well above five-year average of $60. Both natural gas and coal prices are projected to ease in 2023 from record highs in 2022. The report said by 2024, Australian coal and US natural-gas prices are still expected to be double their average over the past five years, while European natural gas prices could be nearly four times higher.