Equity MFs get Rs 15,900 crore in April, up 5x despite volatility

According to Amfi chief executive N S Venkatesh, despite the market volatility in April, retail investors’ trust in mutual funds as an asset class continued to be strong, which is reflected by the yearly rise in assets under management (AUM). The retail equity AUM rose an annual 36% to an all-time high. As of end-April, total assets under retail investors was at Rs 18.9 lakh crore.

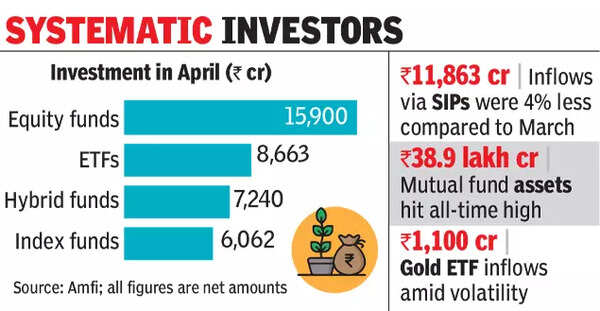

Data showed that last month, net inflows into sectoral and thematic funds were at Rs 3,843 crore, while large & mid cap schemes took in Rs 2,050 crore and mid cap funds Rs 1,575 crore. Total inflows through nine types of pure equity schemes were at nearly Rs 15,900 crore, up almost fivefold from Rs 3,437 crore in April 2021.

Industry players said that investors channelised Rs 11,863 crore through SIPs in April, which was slightly below the March figure of Rs 12,378 crore, but still a good amount. “After witnessing a sharp run-up in the markets over the last few years, the recent correction provided investors a good buying opportunity, which they have been capitalising upon,” said Morningstar India associate director (manager research) Himanshu Srivastava.

During April, the sensex witnessed a smart rally in the first week, going up from its March close of 58,569 points to 60,612 by April 4. However, geopolitical tensions and talks about a sharp hike in rates in the US surfaced, and it dipped to a month-low figure of 56,463 and closed at 57,061. Investors also had to endure sharp intraday volatility, BSE data showed.

Outside of the equity segment, hybrid funds under six different sub-categories took in Rs 7,240 crore within which nearly Rs 4,100 crore was in arbitrage funds, the Amfi data showed.

April figures also enthused those who aggressively support the passive investing process as two of the three categories — other ETFs and gold ETFs — showed strong surge in net flows. While other ETFs took in Rs 8,663 crore in April compared to Rs 6,906 crore in March, gold schemes took in Rs 1,100 crore compared to Rs 205 crore in March. Only index funds showed a dip in net flows — from Rs 12,313 crore in March to Rs 6,062 crore in April, according to the Amfi data.

Gold ETFs witnessed an increase in net inflow in April 2022. This could be an indication that investors were “resorting to gold as a traditional form of investment” that acts as a hedge against market volatility, said Priti Rathi Gupta, founder of the woman-focused investment platform LXME.