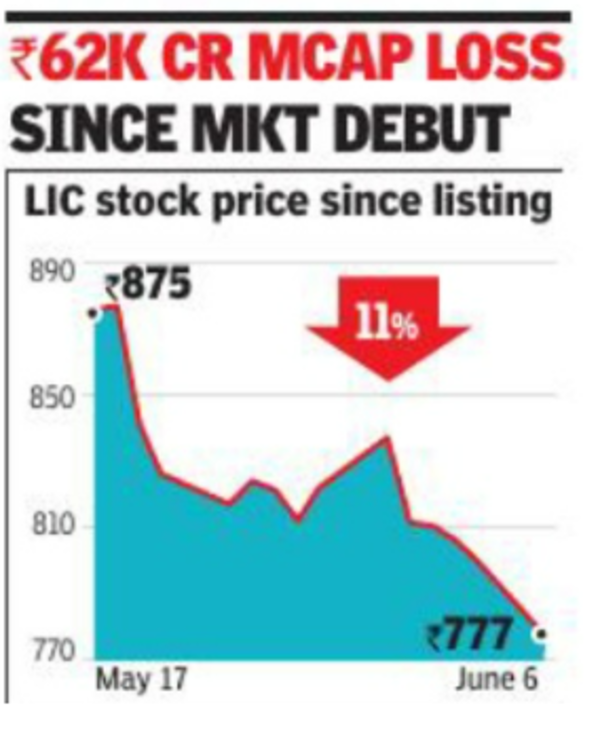

lic: LIC’s stock closes at Rs 777, down 18% from IPO price

At close of Monday’s trade, the LIC’s stock price on the BSE was at Rs 777, down 18% from its IPO price. The all-time low was Rs 775, which was recorded earlier in the session. At close of the day’s trading, LIC had a market capitalisation of Rs 4. 9 lakh crore, which made it the seventh-most valued company in India, ahead of SBI, HDFC and Bharti Airtel, but just behind ICICI Bank. The top three most valued companies in India are Reliance Industries, TCS and HDFC Bank, BSE data showed.

According to a recent report by global financial house Macquarie, LIC’s one-year price target is Rs 1,000. Analysts at Macquarie said volatility in LIC’s embedded value (EV) worried them. Regular manufacturing and services companies are valued based on their earningsper-share or book value. But insurance companies are valued by their EVs, which takes into account the worth of the assets they hold.

The report pointed out that, over time, LIC’s market share in individual business (retail) has fallen due to lack of a “diversified product portfolio and excessive focus on single-premium and group business”. It remains to be seen if LIC is able to diversify its product mix in favour of high-margin, nonpar products, they wrote.

An additional point of concern for Macquarie analysts is the inherent volatility in LIC’s EV.