PFRDA, government in talks to tweak law to cover retirement funds

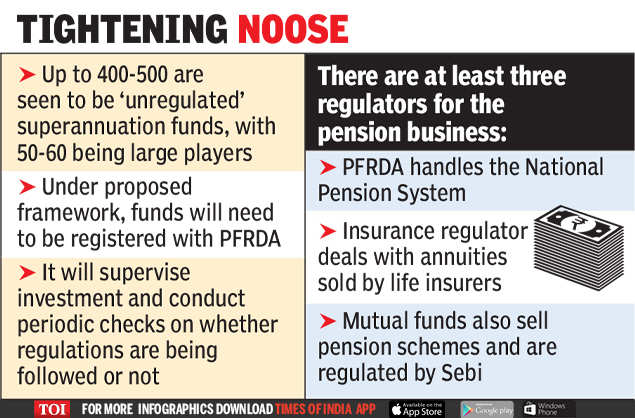

Although there are no official estimates, around 400-500 are seen to be “unregulated” superannuation funds, with 50-60 being large players. There are at least three regulators for the pension business, with PFRDA handling the National Pension System (NPS), while the insurance regulator deals with annuities sold by life insurers. Mutual funds also sell pension schemes and are regulated by Sebi.

“For regulating the superannuation funds that are not under the regulatory control of any financial regulator, we have proposed changes in the PFRDA Act, which is under consultations phase. We are of the opinion that regulatory control is necessary to ensure that the purpose for which the trust was created is being fulfilled by the Trustees and funds are being managed in the best interest of its beneficiaries or employees,” PFRDA chairman Supratim Bandyopadhyay told TOI.

Under the current regulatory structure, these funds receive an approval from the income tax department and are required to follow the finance ministry’s investment guidelines. On superannuation of a member, annuities can be bought, resulting in regulation by the Insurance Regulatory & Development Authority of India.

Under the proposed regulatory framework, the funds will need to be registered with PFRDA, which will supervise their investment and conduct periodic checks on whether the regulations are being followed or not. “We want to safeguard the beneficiaries of such trusts and protect their pension corpus. If the funds are managed properly as per the government-notified investment guidelines, they may continue to do so with an approval from us and if the affairs are not managed in the interest of the employees, we would require such trust to join NPS and follow our regulations,” Bandyopadhyay said.

The debate over regulation of these superannuation funds has been going on for several years with the government — both UPA and NDA — having failed to put in place a framework. As a result, there is no clarity on whether retirement savings of lakhs of investors are being managed properly or not.