Rupee Gains By 100 Paise, Records Best Week In 4 Yrs | Mumbai News

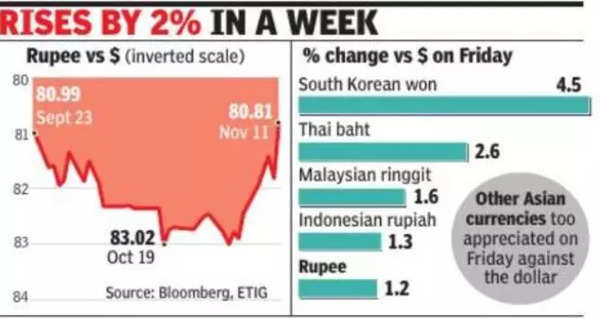

It touched an intraday high of 80.58 before closing at 80.81, 100 paise stronger, according to Reuters. With Friday’s gain, the domestic currency has appreciated 2% in the week — the best performance in four years.

With inflation in the US coming in at 7.7% as against expectations of 7.9%, analysts expect the US Fed to hike rates by 25 or 50 basis points (100bps = 1 percentage point) in December as against the 75bps rate moves in recent months.

Several emerging market currencies gained as the dollar index plunged. The South Korean won closed 4.5% stronger, its best performance since 2009. Other emerging market currencies, including the Thai baht, Malaysian ringitt, Phillipine peso and Indonesian rupiah, gained more than the rupee. The Chinese yuan also gained 0.9% and reports of easing of Covid restrictions boosted markets.

“The gap opening of 110 paise vis-a-vis the dollar was huge. This kind of gap opening was not seen even during the peak of the Russia-Ukraine conflict. It is clear pointer that the dollar was sold heavily in the offshore market,” said K N Dey of United Financial Consultants. Dealers expect that the RBI would step in to stem the appreciation, which will also help to replenish the decline in reserves. RBI data shows that foreign exchange reserves, declining to $530 billion in the week ended November 4 from $531.1 billion as of October 28. Reserves were at $632.7 billion at the beginning of this year.

“As markets in the US were closed today for Veterans Day there will be no inflows on Monday. I do not expect significant gains from here as it is extremely rare to see large inflows towards the end of the calendar year as most investors are into balance sheet management,” said Dey. The rupee’s gains are also likely to be capped because of the firming up of oil prices.