Foreign funds buy stocks worth ₹14,000cr in a week

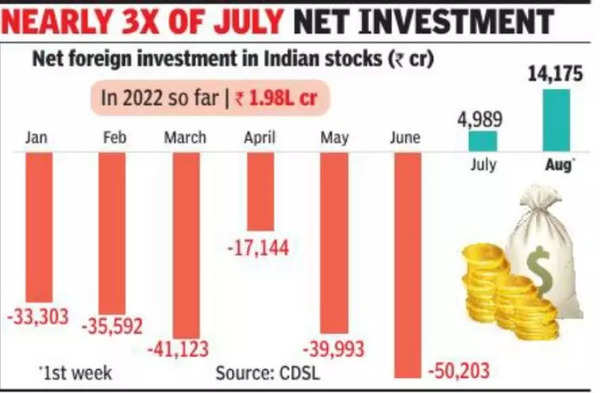

FPIs had turned buyers in July after nine straight months of heavy net outflows, which started from October last year. Between October 2021 and June 2022, they sold a massive Rs 2.46 lakh crore in the Indian equity markets.

Hitesh Jain of Yes Securities said FPI flows are expected to remain positive during August as the worst for the rupee seems to be over and crude oil price seems to be confined in a range. “Also, earnings story still remains strong where sturdy revenue growth is offsetting contraction in profit margins,” he added.

According to the data, FPIs infused a net amount of Rs 14,175 crore in Indian equities in the first week of August. The change in FPI strategy has imparted strength to the recent market rally.

“The decline in the dollar index from the high of above 109 last month to below 106 now is the principal reason for FPI inflows. This trend may continue,” said V K Vijayakumar of Geojit Financial Services. FPIs also poured a net amount of Rs 230 crore in the debt market during the month under review.